Custom Payroll Services for Accountants (CPAs), Accountants, and other Business Management Professionals and Brokers.

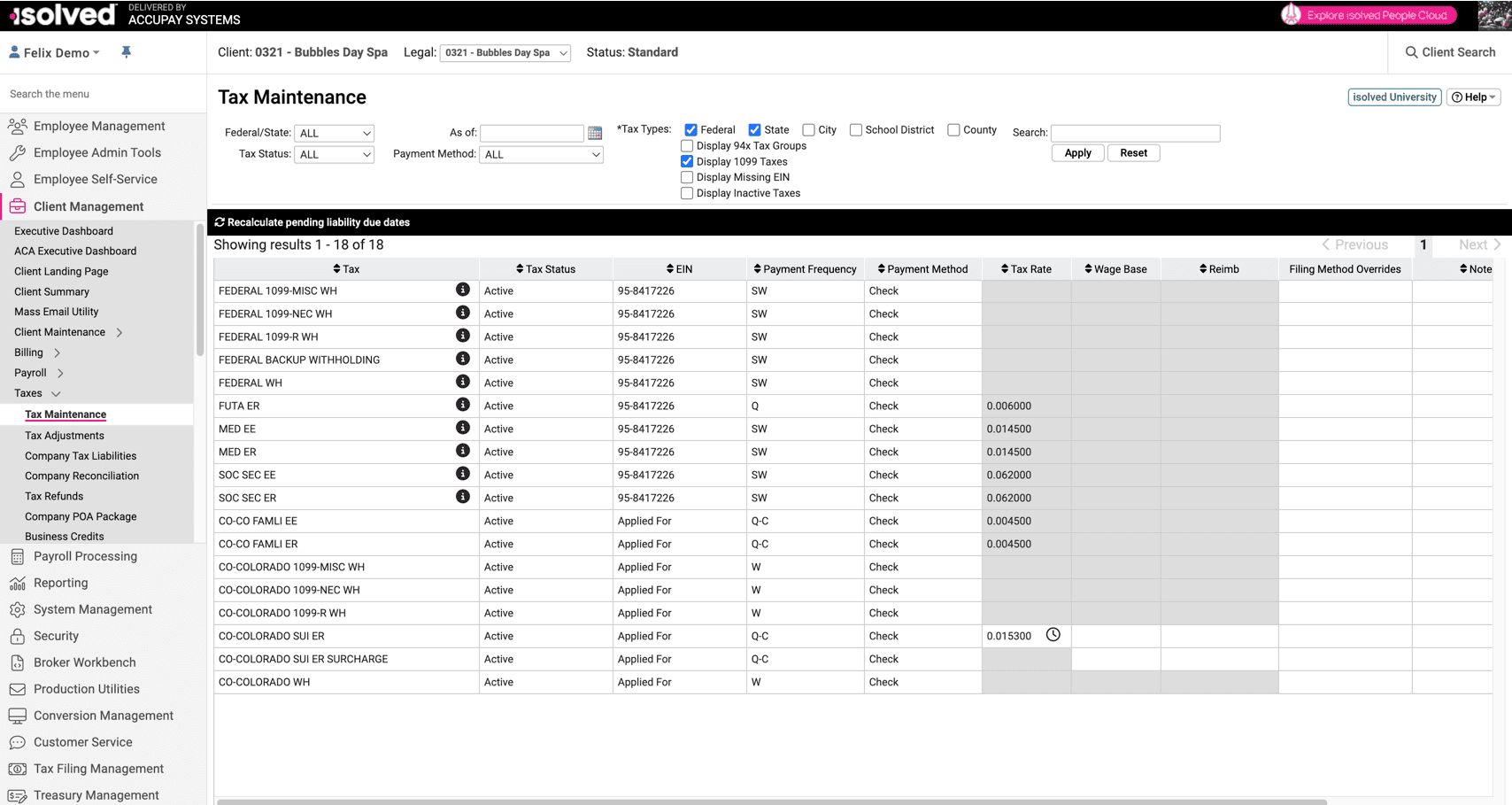

We automate payroll taxes and compliance, so you never miss a filing or risk an audit.

Our dedicated U.S. payroll experts handle everything—so you can focus on advisory work.

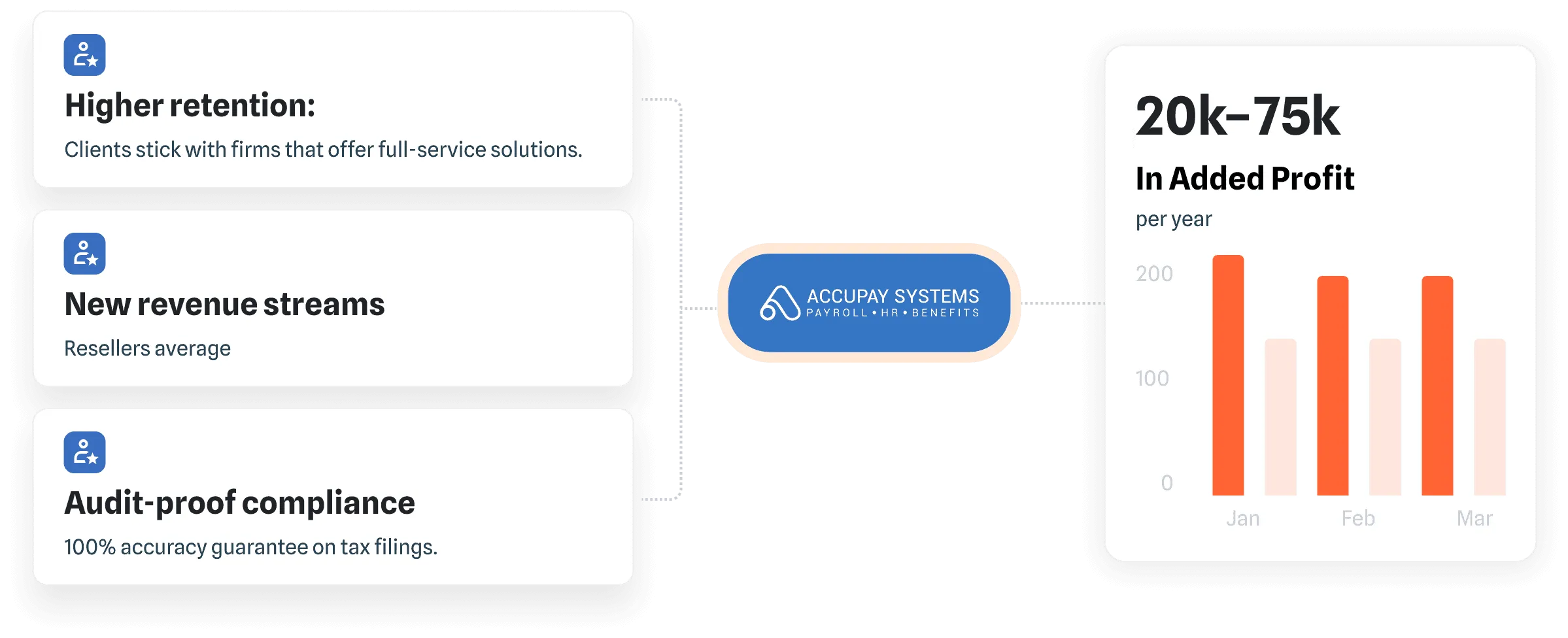

Enjoy referral-based commissions or white-label reselling to expand your firm's service offerings.

AccuPay’s partnership program is designed to enable accountants to offer payroll services to their clients without incurring the associated overhead. This is ideal for accountants who want payroll services that can scale, protect their reputation, and unlock new revenue.

Tax laws and labor regulations change constantly. One error risks your clients’ audits and your firm’s credibility.

Your clients range from solopreneurs to multi-location businesses. Most payroll providers force you into a one-size-fits-all model.

Referral bonuses are pitiful. Reselling requires tech investments. Why partner if it doesn’t pay you back?

Your name is on the line. A payroll mistake or data breach can undo years of trust.

Dedicated U.S.-based support (no call centers), SOC 2 compliance, and error-free guarantees.

Whether you serve 1 client or

200, we scale with you.

Automated payroll with tax calculations, filings, and direct deposit.

Digital onboarding, compliance alerts, and employee self-service.

Geo-fenced clock-in/out and PTO automation.

Auto-filed taxes, labor law updates, and audit-ready reports.

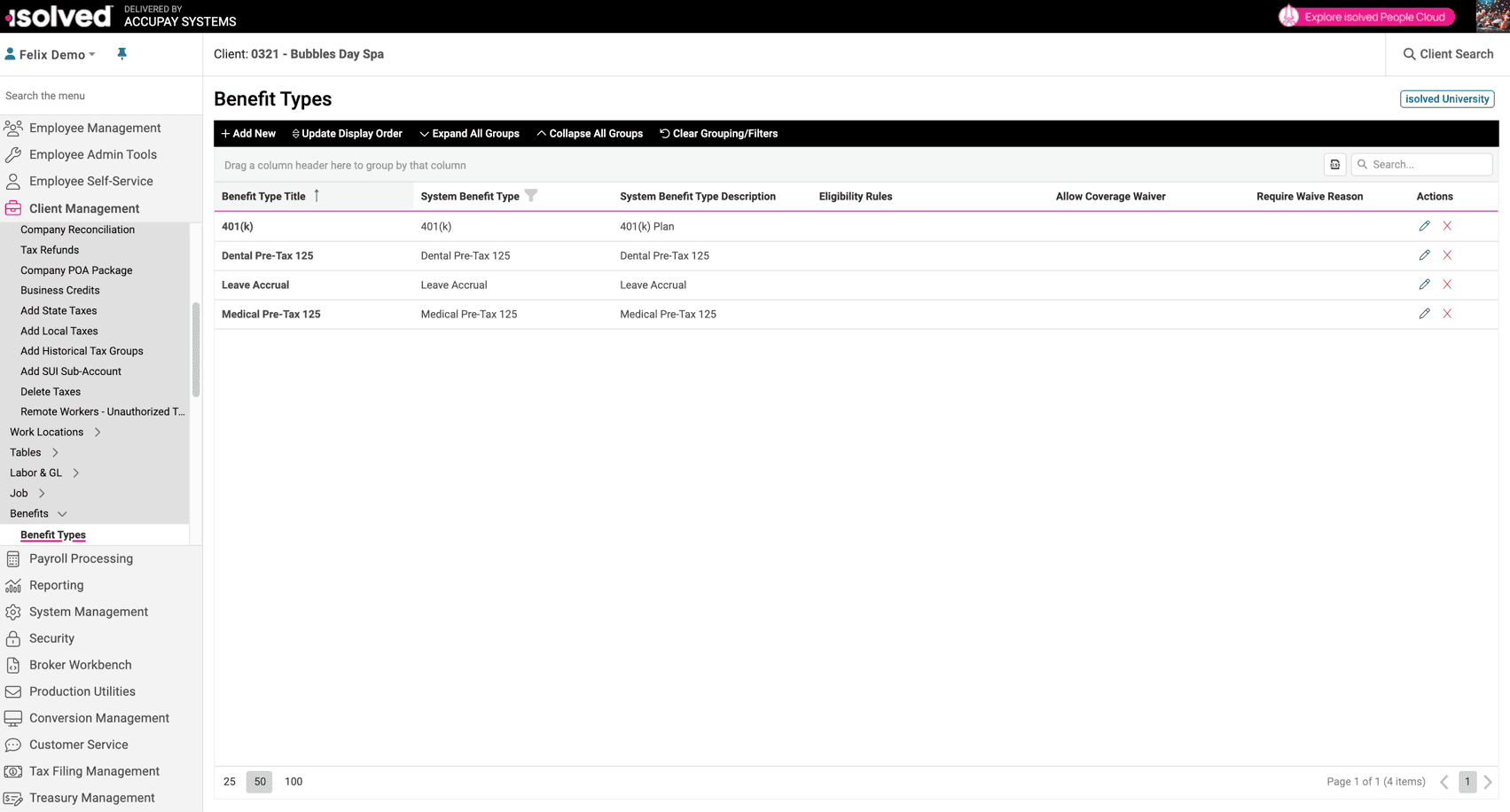

Our payroll services for accountants is more than just the service. Our platform is built to serve all business needs – applicant tracking, benefits, compensation management, electronic onboarding, performance management, timekeeping and scheduling, and many more.

Our team handles payroll, tax filings, and support—so you don’t have to.

Automated payroll, time tracking, and employee self-service tools.

Direct access to payroll experts—not chatbots.

Refer, resell, or co-manage—you choose.

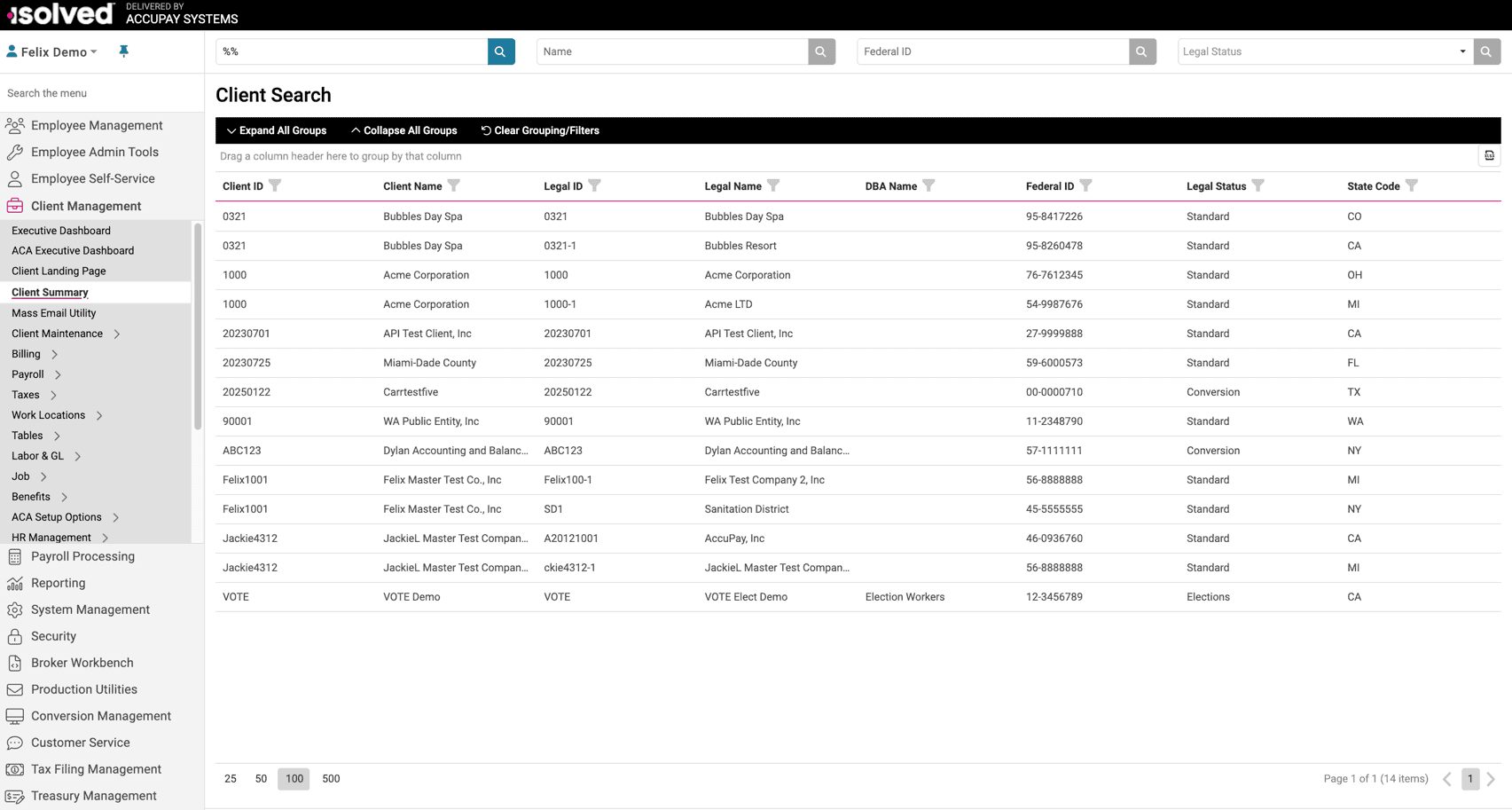

One dashboard to manage all client accounts.

We’ll analyze your client base and goals.

Referral, reseller, or co-managed—onboard in <48 hours.

We handle payroll; you grow revenue and free up time.

We’re so confident you’ll love working with AccuPay that we’re taking all the risk off your shoulders.

If at any point within your first 90 days you decide AccuPay isn’t the right fit for your business:

No red tape. No fine print. Just a guarantee that puts your peace of mind first.

We’re so confident you’ll love working with AccuPay that we’re taking all the risk off your shoulders.

If at any point within your first 90 days you decide AccuPay isn’t the right fit for your business:

No red tape. No fine print. Just a guarantee that puts your peace of mind first.

Absolutely. Our platform is flexible and scalable, supporting sole proprietors with a single employee, as well as larger, multi-state businesses with complex payroll needs, multiple locations, and varying compliance requirements.

We provide dedicated support. Each partner and their clients are assigned a dedicated payroll professional who becomes intimately familiar with your needs. No call centers, no random reps, just consistent, reliable service from someone you know by name.

Yes. We handle the entire onboarding process, including data setup, account configuration, and training. Most clients are onboarded within 2–4 hours. We train both you and your clients to use the system confidently and provide ongoing support whenever needed.

Yes. We are the authorized IRS reporting agent for your clients. We handle all payroll tax deposits and filings, including federal, state, and local forms, accurately and on time, providing peace of mind for you and your clients.

We take full responsibility. If any tax notice or error arises, we handle it directly with the tax agency. As the reporting agent, we manage corrections and will cover penalties or interest if the error was on our part.

Yes. You can export detailed payroll journals and GL files in formats compatible with most accounting platforms, including QuickBooks and Xero, making reconciliation fast and easy.

Yes. We support both manual imports and direct integrations with popular time-tracking systems. We also offer a native time and attendance module as part of our HCM platform.

Yes. We offer flexible partnership models, including referral fees, revenue sharing, and discounted reseller pricing. At this time, we do not offer a white-label option.

Yes. We support our partners with co-branded brochures, joint email campaigns, and customized marketing materials. We also refer our clients to you for tax and accounting services when appropriate.

Yes. We follow industry-standard data security protocols and maintain a SOC 2-compliant infrastructure to ensure the confidentiality, integrity, and availability of all client and employee data.

Our pricing is transparent and flexible. Standard pricing is published on our website, and we offer custom discounted pricing for CPA partners and their clients, based on volume and engagement.

Our prices are consistent and transparent. We do not surprise clients with sudden increases or hidden fees. Our fair pricing and predictable billing are why we’re preferred by CPAs, accountants, and business owners alike.

Yes. Many of our CPA and accountant partners use our platform to fully manage payroll for their clients. You’ll get secure access to oversee multiple accounts, run payroll, generate reports, and ensure everything runs smoothly, under your supervision.